FIDES PATRIMOINE FINANCE and CESSION ET PATRIMOINE

Two main actors for your wealth management.

FIDES PATRIMOINE FINANCE and CESSION ET PATRIMOINE

Two main actors for your wealth management.

The year 2022 was marked by exogenous events which had a significant impact on the financial markets. The Russo-Ukrainian conflict triggered a chain reaction on the prices of energy, oil, gas and electricity and raw materials which generated a return of inflation in Europe and the USA from 1.5% to 15% for certain countries of the EU.

The reaction of the central banks was not long in coming. They increased the rates by 250 BP from -0.50 in 2019 to 2. % for the bank refinancing rate with the ECB. By comparison we were at 4.25 between 2000 and 2008 . We deduce from this that the yield curve is still low and that there is still room for an increase that the ECB can grant itself in the event that inflation continues to rise over the coming months and quarters. It is possible that before Christmas the ECB will increase its rates to 2.5% to prevent any slippage . But the first two quarters of 2023 may mark a slowdown in rates as we are already seeing a decline in commodities and oil and it is possible that an increase in nuclear power generation will loosen the energy vice and inflationary in France as in Europe.

The highly volatile markets fell from 7,000 at the start of the year to 5,800 in June and then rose to 6,700 in December, ie +15%, a salutary volatility for cash holders at the start of the year!

Regarding the USA, the FED has seen its rates rise from 1% to 4.25% in 3 years. It is the tight labor market that is fueling inflationary pressures. Rates will rise less than expected as signals of less progress in inflation are emerging.

Under these conditions, forecasts on the evolution of the financial markets are difficult to make, especially since they depend on uncontrollable international events: Evolution of the Russo-Ukrainian conflict, resumption of economic activity in China still restrained by the Covid effect.

The investment strategy will therefore depend on your portfolios and their degree of liquidity. I invite you to consult the possible investment strategies on my site: Our Investment Strategies . (placementsexpert.com)

In the meantime, I wish you happy holidays and see you next year.

Nicolas BLACHARD

Wealth management advice

PREPARING FOR YOUR RETIREMENT MUST BE DONE DURING YOUR PROFESSIONAL CAREER

OPENING A RETIREMENT SAVINGS PLAN IS AN IDEAL SOLUTION!

Opening and adding to your Retirement Savings Plan (PER) allows you to build your supplementary pension. Thus, in addition to your basic pension, you will have the possibility when you leave to increase your income thanks to a supplementary pension. The icing on the cake, you benefit throughout the duration of the subscription from tax savings based on your payments.

There are many ways to have additional income: the Retirement Savings Plan or PER is one of them!

If you have been planning during your professional activity, you have had the opportunity to open a PER. In this case, if it is well managed, it can allow you to earn additional income. If this is not the case, I invite you to contact me in order to subscribe to one.

The Retirement Savings Plan is a "double trigger" weapon. How does it work ?

With the PER you constitute your own retirement, it is your individual retirement and not collective. So you contribute a certain amount every month, the ceiling of which is defined as a percentage of your income and which differs if you are an employee or TNS. These amounts are placed in equity, bond, euro, real estate, French, European or international funds with many choices offered by insurance companies (about 400).

In the case of an employee, it is 10% of his income. If you earn 100,000 Euros per year, you can pay a contribution of between 10,000 Euros if you are an employee and 18,000 Euros per year if you are a TNS. Two advantages:

The first is that the amounts contributed are deductible from your income declared for tax purposes. So your reference tax income will not be 100,000 euros but 90,000 euros. This simplified example of course highlights that the PER is the best tax reduction tool and the safest because it is regulated!

The second advantage is that you contribute to your retirement and not that of others. this means that when you are going to assert your pension rights, the insurance company will calculate your "additional" pension according to several parameters: life expectancy, the amount of contributions paid and the valuation at exit of your payments that have been placed since subscription.

If your wealth management advisor has invested your money well by adopting a good asset allocation, you should come out with a pension supplement of between 20% and 30%. In the other case, it is always possible to transfer the contract to Fides Patrimoine Finance for more active management because the secret of an efficient retirement is based on the allocation of assets, i.e. on the investment vehicles chosen. .

There is always time to open a PER and it is even possible to open several. At Fides Patrimoine Finance you will find "tailor-made" solutions.

Looking forward to meeting you, do not hesitate to visit our site. https://www.placementsexpert.com .

Nicolas BLACHARD

Wealth management advice

A brief reminder of the evolution of interest rates over the last 20 years in France. We must put the rise in interest rates in the French economy into perspective because it will not be a brake on GDP growth.

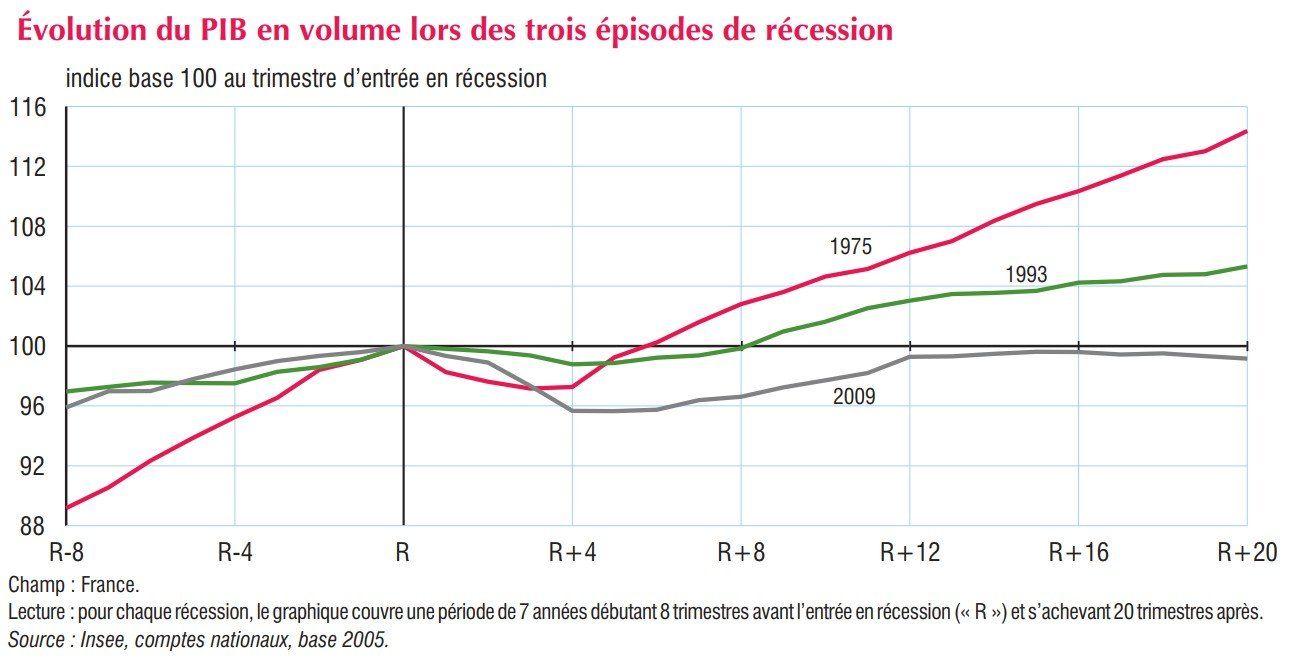

The last episode of recession in 2009 was due to a fall in productivity reflecting a contraction in exports. It explains the slowness of the recovery, but neither inflation nor the rise in interest rates was a major cause . Inflation in 1975 was 11.8% and 2.1% in 1993 with growth picking up much faster than in 2009.

So are the rumors of a recession true? Judging by the companies' results and the ability to adapt to the new parameters, rising energy costs and rates, they should be fine. It is the production capacities, therefore the bottlenecks on certain products that will have to be monitored.

Europe has taken initiatives to replace Russia as an energy supplier. Financial markets are unscrewing for fear of a recession, but monetary and budgetary policies should limit the damage . The rise in central bank rates and budgetary “easing” is planned in order to preserve the purchasing power of Europeans. In the end, the growth of 2022 in France should remain positive as in the Netherlands in Germany, Spain and Italy as well as in the whole of the European Union.

But the specter of recession is not dismissed in 2023 with the total shutdown of gas supplies to Europe by Russia. It should be noted that in 2022 Russia supplied Gas to European countries during the first 6 months of the year. The situation will be completely different in 2023 and it is therefore a race against time to develop renewable energies and negotiate with new suppliers.

The recession will be proportional to the adaptations of the European economies and it can be avoided if we find permanent substitution solutions in the next six months. In this specific case, we can expect a lull in inflation and interest rates. This is why the financial markets react quickly to good and bad news on energy and on the evolution of the Russo-Ukrainian conflict.

Given the low valuation of companies it is wise to take positions now and wait one to two years. Companies in the renewable and clean energy sectors will be favored. For investment ideas, I invite you to consult the site http://www.placementsexpert.com.

In May I had mentioned in my newsletter 104 a rise in rates for the end of the year of between 0.5 and 1%. We had 0.50% in July and it looks like another 0.75% ECB rate hike is expected . We finally return to the classic economic theory where money has a value!

A necessary signal to curb inflation and raise the Euro/Dollar parity which would reduce energy and raw material import bills.

Bad times for start-ups, their valuation and the search for financing. Investors will become more demanding and many business plans will not meet their objectives in the next two years, resulting in an acceleration of bankruptcies.

The corollary of this situation is the lack of visibility of business leaders over the next 3 months fueled by geopolitical uncertainties: persistence of the Russian-Ukrainian conflict and Chinese intervention in Taiwan. This last hypothesis could lead to an explosive situation with the USA and significant consequences on world trade and financial markets. On the other hand, the lull on the Russo-Ukrainian front could revive the financial markets upwards as well as more favorable economic indicators.

In terms of investment, real estate should be considered as a solution limited to 25% of your portfolio as the constraints in France are more and more numerous and profitability is falling.

Don't forget to diversify your assets: Give priority to SCPIs, certain bond issues and falling financial markets which present entry points with a CAC 40 close to 6000 interesting points.

For more information I remain at your disposal and I can advise you on the opening and supply of a PER, life insurance and your taxation. In real estate if you have a sales project please contact me.

Welcome back to the office

Nicolas BLACHARD

Wealth management advice

The main cause of variations in market indices is uncertainty.

The world is going through a time of transition

This translates into an increase in volatility which is around 28 on the Eurostoxx50 and the SP 500 . A doubling of the indices compared to normal times.

Two major transitions: Geo-strategy with the fear that the conflict will harden between Russia, Europe and the USA, resulting in an increase in raw materials.

An energy transition in Europe that has never had a sovereignty strategy apart from France. The consequences are a return to inflation of 8% on average in Europe VS 5.5% in France and a rise in 10-year OAT interest rates > 2% VS 0 at the start of the year.

The question is how long will this transition last?

From the energy point of view, the renegotiations of contracts with third countries combined with an increase in investments in new energies should begin to produce their effects at the end of 2023. In Europe The winter of 2022-2023 will be a decisive element in the management of gas and oil energy, it will be an indicator of the outlook for growth and inflation.

From a geostrategic point of view, it will be necessary to "be patient" because no one knows how long the conflict will last and if it will intensify with the arrival of Finland and Sweden as new members of the NATO.

Some positive points anyway: Reopening of China to world trade with the Covid episode down. Improvement of the "supply chain" to streamline the production chain but beware of the "stop and go" policy and the underlying real estate crisis. The advantage of China is that the Chinese government is in control.

In terms of investment, I cannot advise you to go for alternative investments and certain bond issues. There are yields to be taken both on bonds and opportunities to be seized on equities over a two-year horizon.

In terms of business cash flow, I want to provide you with short-term investments that can meet your needs. For any type of investment do not hesitate to consult me.

Have a good summer and see you in September

Nicolas BLACHARD

Wealth management advice

Newsletter 105: uncertainties about the evolution of world economies remain.

The concerns expressed in my previous newsletter remain valid. Inflation, increase in interest rates, decline in economic activity with nevertheless an improvement in China on the COVID since Shanghai is deconfining which will make it possible to relaunch the production of goods and technological components necessary for our industry. Nevertheless, since the beginning of the year the price of Freight has quadrupled, which considerably slows down and increases the cost of world trade.

Given the circumstances and this sustainable environment, here are some investment strategies that can pay off in building a balanced portfolio.

In the 6,000-6,300 Points range, the CAC is in “low water” most of the bad news is integrated into the markets and the economic measures taken by the government to preserve the profitability of companies and the purchasing power of consumers are much more favorable than in all other European countries. At this stage investing in stocks for a period of two to three years is recommended.

The statistics on The History of economic and monetary crises with or without international conflicts show that investing in times of crisis offers considerable returns on investment on equities (3-5 years)

Don't forget the golden rules: Don't put all your eggs in one basket, that is to say diversify your investments and invest regularly to smooth your purchase prices. Finally define your investment term.

To balance your portfolio and build up annual income, invest in unlisted bonds which are much more profitable than listed bonds (> 2 points). I have at my disposal a set of bonds that pay between 5% and 9% per year, insensitive to changes in rates over an average period of 5 years.

Structured products are a source of income of around 6% per year when volatility is high and indices are rather low, as is the case today. It is above all a question of carefully selecting the structured product and on this level I can intervene.

Finally, SCPIs over a period of 10 years are intended to compensate for the low yield of life insurance funds in Euros and generally offer 2 to 3 additional points. I can recommend a number of SCPIs in which I have invested for years.

I am at your disposal to discuss it with you and do not hesitate to contact me on this subject for an appointment.

Good day to all

Nicolas BLACHARD

These two events contribute to the decline in global and European growth revisions. On the European side, we are in a situation of quasi-war that governments refuse to recognize so as not to panic public opinion and the economy.

On the Chinese side, the presence of COVID and the population quotas are causing a slowdown in the economy, shortages and major disruptions in the production and logistics chains.

The corollary of these effects translates into a substantial rise in inflation in Europe to 7.5%, limited in France to 4.5% (thanks to government measures) and the accentuation of budgetary imbalances which could reach 6% of GDP.

This explains the fall of the CAC 40, Eurostoxx50 and SP 500 over the last 3 months -10% for the French and US indices, -12% for the European index.

As a result, global growth as a whole has been revised downwards by the IMF, 2.8% for the Euro zone (down by one point), including 2.9% for France and 2.1% for Germany and 3.7% for % for USA.

On the side of emerging countries, 4.4% for China instead of 6% and 8.2% in India, one of the least impacted countries.

However, the risk of stagflation cannot be ruled out; it will depend on the price of oil and the evolution of the two current concerns.

This complicates the position of the ECB in terms of interest rates, which is obliged by its statute to control inflation and officially stop its tapering. This will be the signal of a rise in refinancing rates which could finally be positive

(0.5% - 1%) by the end of the year.

What is the stock market outlook? From the first announcements of rate hikes, funds in Euros and Bonds will now be an asset class to invest in your portfolios to secure it. The impact on equities will be moderate and will depend on the investment sectors chosen.

Priority should be given to certain high-growth sectors such as luxury, renewable energies, the environment, defence, cybersecurity and IT. Others deserve to be more vigilant because of their volatility: automotive, aeronautics, construction.

What will be the impact of a rise in interest rates on the real estate market?

Currently we are witnessing a stagnation of sales in Paris and in some large cities linked to new remote working methods (teleworking). Employees thus prefer to move away from large cities and invest in medium-sized towns where the price per square meter is more affordable. Montpellier, Nice, Nantes and St Etienne are experiencing double-digit growth. We are witnessing a paradigm shift (lifestyle and mentality) of employees, favoring settlement in smaller towns and rural areas. On the societal level, this new dynamic will make it possible to revalorize territories that were once neglected with a direct effect on employment.

In real estate I am looking for commercial premises for rent or for sale in Paris, RP or PACA but also offices and hotels, please contact me.

In terms of retirement, I cannot advise you to open a Retirement Savings Plan, the best investment tool while reducing your taxes. The same applies if you have needs in terms of sickness and health insurance for you and your employees. For all these subjects you can contact me.

Finally, if you have business cash to invest, I have investment solutions over a two-year horizon.

See you soon

Nicolas BLACHARD

Wealth management advice

More than ever, we remain in economic and political uncertainty, which raises questions about the right “Policy mix” to adopt. The strategies must be redefined according to the following parameters: inflation between 4-5%, our dependence on raw materials and our national and European sovereignty in terms of energy.

As a result, the debates on Socially Responsible Investment and the environment are no longer topical (apart from the electoral campaign) but we focus on the themes mentioned above. Europe and the ECB are on the move because we are in a "casi-war" economy, which implies in Keynesian economics: letting the deficits slip away and controlling inflation above 2% (threshold defined by the ECB's mission) . The ECB will necessarily raise its key rates after the FED.

The advantage of this conflict is that it highlights the shortcomings of the European Union over the past 30 years in terms of autonomy in energy, raw materials, defense and technologies. The Franco-German couple as a European engine is a decoy because the Germans show their dependence in terms of military equipment with the Americans and energy with the Russians, and have not endorsed the development of the nuclear industry supported by the French in clean energy. Policy error? possible, in any case these are two sectors where France holds the leadership in Europe with aeronautics.

Innovation, technologies, energy, energy transition and raw materials are the main pillars of economic and sovereign development in Europe, all of which has been ignored by European leaders in recent decades. Now Europe must make up for lost time and invest massively in these sectors.

For all these reasons the financial markets “swing” between highs and lows going from 5,800 points to 6,800 points thus taking up 18%, a paradise for traders.

You have understood that your future investments in the stock market should be oriented in the sectors mentioned above, Defence, new energies, technologies and take advantage of falling prices. For more information www.placementsexpert.com . The results of the companies are rather good and many companies have considerable development forecasts in France for 2022.

At the end of January-beginning of February I had published "the economic outlook for 2022 subject to a return to normal for the world economies" (see www.placementsexpert.com Economic Indicators section).

If you want to trade, you will have to position yourself on commodities.

2021 ended in apotheosis on the financial markets since the CAC reached historic highs by exceeding the

7,000 points with 28% growth. The SP 500 wins nearly 25%.

As in the previous year, it was the technology, luxury, healthcare and biotech growth stocks that performed best.

The beginning of the year looks strangely like last year: Appearance of a new virus and reinstatement of telework for 3 weeks, introduction of gauges. The economic consequences on the transport, entertainment, catering and event sectors are significant even if the measures taken by the government are intended to avoid paralysis of the economy. However, the markets are not worried and the growth of the CAC continues reassured by a less virulent virus.

Do not expect performance this year as good as in 2021 for the reasons mentioned below.

What is expected for 2022 is the resurgence of inflation in the USA and Europe, an increase in interest rates from the FED followed by the ECB which could thus sign the knell of negative interest rates . Out of stock and supply chains will lead to cost inflation before a return to normal at the end of the year or 1er half of 2024 in the absence of other pandemics or exogenous shocks.

On the investor side, equities and real estate (1,200,000 transactions according to the president of the FNAIM) have performed well this year. Real estate is slowing down for Paris and accelerating in medium-sized towns. We note an increase in prices for apartments of +6.1% for houses +8.2%.

Average price in Paris €10,200/m2, -0.9% drop against 4% in Ile de France.

The latest Fnaim survey confirms that only 28% of young people want to live in an urban environment .. the exodus from city centers is increasing Marseille + 6.6% is increasing more slowly than in all medium-sized cities above 7%.

2022 is likely to be more difficult in terms of transactions due to the tightening of diagnoses, the rise in rates and the stagnation of purchasing power. But it is the speed of the return of foreign investors and their number that will move the market if sanitary conditions improve.

To conclude on investment opportunities, we remain positive on equities, the main vector of investment, but not at any price. Other assets such as Bonds convertible into shares and the unlisted market also have our preference.

As for the sectors, health, IT security, tech, SRI and all titles related to new energies and the environment.

I wish you a happy new year 2022 and above all good health as well as to your loved ones.

Do not hesitate to contact me for your problems in terms of life insurance, pensions, health, retirement and taxation.

See you soon

Nicolas BLACHARD

Wealth Management Advisor

Return of COVID new version.

Resurgence of inflation with rates of 4.5% - 4.9% in Europe but 2.5% excluding energy and food.

Uncertain monetary policies. The ECB does not want to talk about monetary tightening but it will have to.

The 2022 growth forecasts could be called into question depending on the health situation, the evolution of international relations between the three major USA, China, Russia and the multiple local crises and conflicts in Europe and the rest of the world (immigration, Turkey, Africa, energy and raw materials)

Consequence: Market volatility picks up again. More than ever, thematic strategies are topical.

The investment universe is shrinking because interest rates are low and bonds are no longer doing their job of safe and profitable investment. On the other hand, the overheating of indices suggests that the equity market may correct what has already begun. Finally, discounted “value” stocks have not taken off due to an environment that has not yet stabilized and which remains uncertain.

In this case, what are the investment alternatives?

Investing in unlisted companies and thematic shares are those that allow for interesting performances. On the unlisted market, the bond offers attractive yields (5-7%) and on the thematic markets, double-digit performances remain topical in the tech, health, safety and environmental universe.

These are obviously the strategic sectors of the future which continue to perform even if a correction would be welcome.

What forecast for 2022?

When the Hong Kong markets have lost 17% since the 1er January, the European and American markets take 24% for the CAC, 10% for the eurostoxx and 39% for the SP 500.

But the uncertainties mentioned above linked to the deterioration of international relations can presume a very volatile year 2021 with pronounced "swing" effects.

Be that as it may, many values remain downgraded, such as air transport, but also small and mid-caps that are often neglected and certain Chinese and European tech companies which deserve to position themselves provided they have a little patience for performance in a universe of 2 to 5 years in double digits.

Thank you all for your loyalty for so many years and see you next year for new info. Have a good holiday.

Nicolas BLACHARD

Wealth management advice

The beginning of the century resembles the previous one, paradigm shifts that will cause a transformation of the world.

While the beginning of the 20th century was synonymous with industrialization based on the development of oil and coal energies, the consumer society and saw the advent of the USA as a world power to the detriment of Europe, the beginning of our century sees the emergence of new values in a very different environment.

The world and the 200 countries that make it up are becoming aware of the urgency of protecting our planet from global warming and the necessary ecological transition. The various COPs want to bring about sustainable growth without altering our global heritage in order to limit temperature rises and their consequences on the world's population.

At the same time, if the virtues of economic growth are not called into question, it is subject to new obligations such as the development and use of so-called “clean” alternative energies different from oil and coal.

Finally, the center of the world is moving towards Asia, with China as the main beneficiary, which is increasingly asserting its place as world economic leader.

Thus the new world will be both different and similar to the world before with, as usual, the risk of conflict between the 1st and 2nd world powers in the China Sea and military and quantum computing budgets in strong growth (+ 40% for the USA with 738 billion USD and +10% for China 193 billion USD according to IIES.)

Technology will be the key to progress both to develop the renewable energies necessary for the "decarbonization" of the planet but also for the economic supremacy linked to scientific research. Health is becoming more dependent on technology and highlights issues of sovereignty that have long been set aside at the European but also American level against the backdrop of the trade war (for now) with China. It is Ricardo's sacrosanct theory that is called into question.

The Western world is therefore moving towards a hardening of its positions vis-à-vis China, which does not respect trade treaties, with the consequences of a return of basic industries considered to be strategic (chemicals, vaccines, aspirin for health, semi-conductors) on American and European soils. Doesn't the growing mistrust of the Western world and the persistence of trade deficits vis-à-vis China risk “partitioning” world trade and accelerating inflation?

The consequence could be an intensification of trade between the West and its allies to the detriment of China and therefore global growth (which has already restarted) which would depend less on Chinese performance. The return of reasonable inflation is likely, especially if central banks reduce their intervention in 2022.

Consequently, the investment themes for the coming months are directly linked to future developments: SRI funds and securities, new energies, tech, digital, health, transformation, environment, internet and cloud.

The so-called “undervalued” defensive stocks remain interesting; they should come back to the fore at the end of the year (Air France, ADP, Banks, etc.). you can visit my site www.placementsexpert.com "Investment recommendations" section for more information.

I remain available for your needs in life insurance, pension, health, expatriates and retirement.

The risk of rising rates mentioned in my previous newsletter seems to be confirmed by the increase in the key rates of the Central Bank of Norway by 50 basis points .

The FED is preparing people for a gradual tightening of the liquidity supply and the still undecided ECB will certainly follow the trend . The French and German 10-year bonds are now in positive territory and the American 10-year bonds have exceeded 1.50%, a sign of the return to a certain financial orthodoxy appreciated by the Germans and the Dutch. The financial markets should not be impacted because the economic recovery is vigorous in Europe (6%), the United States and China over the next 6 months.

The real clouds will appear in 2022 linked to the international context: relations are increasingly conflictual between China and the rest of the world, more particularly with the Western world USA, Europe and Australasia.

The risk of a military conflict in the China Sea linked to American ally Taiwan is a worrying element for the stability of the region and economic growth.

There is also the economic aspect where China is enacting more and more regulations and barriers in order to prevent the development of Western societies in its country while trying to circumvent international treaties and trade rules by threats or thinly veiled sanctions (especially Europe).

At the same time, the Chinese government is implementing a national preference plan to ensure its own commercial autonomy and reduce the share of European and American imports, which will surely have an influence on the world growth rate in 2022, which could drop below 4%.

The problem of the shortage of raw materials and semiconductors where Beijing plays a leading role since 80% of the needs for the automotive, computer and telephone sectors are concentrated on its territory will probably strengthen cooperation between the USA and Europe and thereby ironing out areas of contention related to tariff barriers. Europe has finally measured its dependence and is beginning to take measures, but it's not too late when the USA has already secured its supplies through agreements with TSMC in Taiwan and INTEL, which manufactures a gigafactory in Arizona.

As for the last quarter of 2021, the markets seem to be working well without bubbles and the rise in interest rates is already priced in. The fall of 200 points in one month in the CAC is salutary and shows that the markets are reacting well, which excludes the possibility of a crash, “all other things being equal”. Ditto for the SP 500 which lost nearly 250 points in one month (4,305 points).

In the meantime, corporate results are particularly good and it is growth stocks that hold the ground . Defensive stocks called "undervalued" having a little delay in the recovery, they should return to the front of the stage at the end of the year (Air France, ADP, Banks, etc.). you can visit my site www.placementsexpert.com investment recommendations section for more information.

I remain available for your needs in life insurance, pension, health, expatriates and retirement.

The Covid variant creates uncertainty about the long-awaited recovery in September even if the indicators are green and the expected annual growth is around 6%.

The stock market is high because there is a lot of cash to invest, but consolidation cannot be ruled out over the last four months if the macroeconomic forecasts linked to the recovery are not forthcoming.

A risk of rising rates for 2022:

The risk of rising rates in 2022 may impact securities without slowing down real estate investment projects. Indeed many real estate projects are in the pipeline by city dwellers wishing to “escape” the very big cities.

Our recommendations:

Invest in undervalued stocks that are lagging the recovery. They will benefit from a spectacular recovery as soon as the health situation is resolved. Nevertheless the timing can be a little long 6 to 12 months but interesting in terms of performance.

you can visit my site www.placementsexpert.com investment recommendations section for more information.

Markets are calm and CAC transaction volumes have fallen by 40% since July 14.

They evolve around a range of 6,500 points on the CAC. Even if we observed some upheavals with a fall of 200 points during July, volumes remain low and the upward correction is taking place quickly.

For opportunists these are interesting entry points and it is not excluded that by the end of August new opportunities will arise.

The problem today focuses on the sustainability of the return to growth in Europe and the United States, which could be compromised by the arrival of a fourth wave of the virus.

Markets have started to factor it into the pace of growth and valuation of companies. The prices will therefore depend solely on the accuracy of the forecasts with two scenarios:

- Growth weakens moderately as expected, thanks to an increase in the vaccinated population which will prevent an overload of health services: in this case, prices could evolve durably in a 6,700-6,900 range to reach 7,000 points at the end of the month. year (high 6944 on September 4, 2000).

- Or else all the forecasts are revised downwards because of the greater risk of the variant and a return towards 6250 is possible.

And all this without major political or international crises!

In any case, it is wise to have a little cash in your portfolios to invest in stocks that are either discounted or others that will start falling again (to be kept for around 2 years).

Concerning the central banks (ECB and FED), they should renew their monetary and budgetary policy because in the absence of inflation their concern remains economic recovery.

I wish you a good holiday and you can consult my site www.placementsexpert.com investment recommendations section for more information.

Cession et Patrimoine is developing in the south with my partner Eve Crespi and if you are looking for a house near Cassis, La Ciotat, Bandol, Sanary we have properties to offer you.

If you need personal insurance, I remain at your disposal.

I wish you happy holidays after this difficult time.

Nicolas BLACHARD

Wealth management advice

Rarely have we had such a resplendent economic situation.

In France The end of confinement is materialized by a growth of 6%, i.e. three times more than normal, an inflation of 1.5% and an increase in household spending of more than 10% thanks to the accumulated savings of 350 billion for one year . Traders are satisfied and rub their hands with the opening of the balances.

The CAC at 6,500 points gained more than 18%, the S&P 500 and the Nasdaq set new records at the end of June with more than 14% performance while approaching 4,300 points, the highest levels for 10 years thanks to GAFAM.

With annual growth of 6.4%, the FED revised its forecasts upwards to 7% and inflation to 3.4% against 2.3% the previous year. Even if the FED admits inflation of 3.6%, it forecasts a drop at the end of the year to stabilize around 2.2% in 2023. This is why rates remain moderate at 0.25% for the two-year and 1.49% for the ten years. The unemployment rate should drop from 5.8% to 4.5% at the end of the year to reach 3.2% in 2023 under the effect of sustained growth.

In France The cash flow of large companies is flourishing, that of SMEs and VSEs less so, but is holding up thanks to financial measures of more than 400 billion in state aid. On the other hand, the public debt is increasing to 124% of GDP, which will pose repayment and credibility problems with the corollary of a possible rate hike for the years 2022 and 2023. But the dreaded wave of bankruptcies will not materialize as soon as I I talked about it in a previous newsletter. On the other hand, a bubble phenomenon on the many IPOs could form within two years with many disappointments.

In short, all is for the best in the best of all possible worlds.

On the real estate side: sales volumes are breaking records, especially in medium-sized towns + 7% in price on the old. 22% of French people bought in small and medium-sized towns. The more frequent use of telework, prices and quality of life are the main causes.

In Paris, prices are settling on average by -0.9% and 60% of French people want single-family homes, which is causing prices to rise in the provinces and IDF by around 6%.

Medium-sized cities such as Nîmes, Nantes, Angers Limoges, Poitier show price increases of more than 7%. In Aix en Provence, it is difficult to find a 120m² apartment or a well-placed house. Medium-sized towns are catching up in the capital!

In new real estate Paris, Lyon, Bordeaux and Nice monopolize the first four places and Marseille eighth according to the real estate laboratory.

Access to credit is tightening under pressure from the Banque de France with an increase in personal contributions, but rates remain low (1.5% over ten years on average).

In the absence of another health crisis at the start of the school year, the restructuring is confirmed in office real estate (already mentioned) towards offices with areas limited to 10,000 m² and co-working will favor local offices of 150 to 2000 M² located near employees in telework in IDF or province. On this type of surface, Paris will be highly sought after.

On the financial markets, opportunities are rare, but on declining and undervalued stocks such as Air France, Ryan Air, Atos, Iberdrola, there are interesting entry points. The themes of water and new energies are more topical than ever, but beware of the pitfalls of “green bonds” SRI, sustainable (socially responsible investment and governance), ESG (social environment and governance) funds. For more details www.placementsexpert.com“Investment recommendations” section.

Do not hesitate to contact me and see you very soon.

The global economy is rapidly shifting back into “growth” mode and starting to take full effect with a continued rise in financial markets. But will it last?

Is there still a significant margin for market growth and interesting stocks to play?

On the markets, the macroeconomic importance of the next growth and inflation indicators will have a direct influence on the indices. In other words, if there is a return of inflation in the economic sense of the term, that is to say a general increase in prices, we can expect consolidation. Ditto if the growth figures for the world economy are disappointing. For the moment none of these configurations are envisaged and especially not inflation which remains around +33 6 13614012% in Europe rather centered on certain sectors, and offset by an increase in productivity.

Few inflationary risks between now and the end of the year, which is why the European Union and the ECB have decided to act in concert so that the planned issue of 350 billion Euros of debt is carried out at a rate close to zero.

The EU is once again acting late and is implementing inappropriate policies with economic decisions that should have been taken at the start of the crisis and not at the end of the crisis. This increase in public debt makes no sense and will have very little effect in terms of growth on an already present recovery. Worse, the first subsidies of around 10% will only be available to member states at the start of the school year, which will be too late to act in the event of a crisis this summer.

Excessive debt and procrastination one can wonder about the relevance of this strategy.

It is not a recovery plan by country that we need but a financing plan for the sectors considered strategic for tomorrow. Brussels is still making mistakes in financing public policies and its blindness is equal to the ignorance of decision-makers on the real economy.

Are there any interesting titles? of course we must focus on those who have not yet benefited from the recovery but who are in the restructuring/merger-acquisition phase and those whose discount is exaggerated (Stellantis, Atos, Ryan Air). The themes of water and new energies are more topical than ever. If the March-May 2020 period was interesting in terms of acquisition because of the systemic fall in the markets, it is now necessary to be more attentive in the process of acquiring securities. For more details www.placementsexpert.com “Investment recommendations” section.

I am also always looking for real estate to buy or sell in housing, shops and offices, and I remain available for your needs in life insurance, providence, health, expatriates and retirement. The real estate statistics of the last few days confirm the recovery mentioned in my previous newsletters and the site of my friend Guy Marti, www.pierrepapier.fr will allow you to get an idea of the investments in real estate that I can also offer you.

Do not hesitate to contact me and see you very soon.

Recovery of the economy, rise in the financial markets or are we there? Europe, the USA and China: Three different pictures of the recovery.

Three different crisis managements for the 3 largest economic powers in the world. These three continents represent 80% of global GDP but operate in radically different ways through different decision-making processes.

Unsurprisingly, the two largest economic powers on the planet have succeeded in their economic recovery. Whether it is an authoritarian regime like China or a liberal one like the USA, all are characterized by a single decision-making center and a “dynamic” management of the crisis driven by one objective: to be the world leader.

Opposite Europe, "the old Europe" penalized by decisions that must be taken at 27 and a finicky bureaucracy devoid of vision and objectives appears like the turtle.

Among Western democracies, the United States, which represents 330 million inhabitants, is the one whose recovery has been the fastest. The growth rate at 1er quarter is 6.4% and an estimated 300,000 jobs will be created for the 1er quarter of 2021. The American liberal system often decried for its weaknesses in social policy allows a single decision-maker, the president, to make decisions that are implemented quickly. Less bureaucracy, and coordination that allows a policy of direct aid to Americans with a check for 1,800 billion USD to American families, a plan for financing the economy of 900 billion in December 2020 supplemented by 2,200 billion at the end of March invested primarily in infrastructure. At the same time, the FED's appropriate monetary policy makes it possible to maintain interest rates and a weak currency through a direct, massive and immediate injection of liquidity, the parity of 1.20 USD / € suiting the FED well.

Thus Productivity increases by 4% which allows companies' margins to be maintained and to hire.

Kesenianism is back, especially when we control the currency which represents 80% of international trade.

On the other hand, China, which adopted the rules of capitalism under an authoritarian regime, was the first to restart with a growth rate above 8%. Here too, with a single decision-making center and coordination of monetary policies, the Chinese government has regained control of financing circuits and reduced “shadow banking” (see the Ali BABA and Jack MA affair). Result: controlled interest rates and a currency that remains competitive to preserve the fundamentals of the trade balance. At 7.80 Yuan /€ China aims to compete with the Dollar on the international scene by accelerating the development of the Digital Yuan.

The political and economic competition is relaunched between the two big ones and we can say that the health crisis is behind them.

The contrast is striking with “old Europe” as exclaimed a former Minister of Foreign Affairs who does not yet see the end of the tunnel and who is far behind in all economic sectors. By dint of having wanted to be too protective, our continent and our technocrats have erected barriers for decades by constantly increasing intra-European trade regulations, thus annihilating the willingness to take risks of a whole generation of young Europeans, thus depriving us of responsiveness. and a rapid return to growth. How many companies created in the last 30 years appear in the world's top 50?... Zero...

The health crisis has only confirmed the hidden weaknesses and the lack of precise objectives and medium and long-term vision of Europe for 30 years.

This translates into considerable delays in strategic sectors: Health, semi-conductors, IT, military and even Space caught up by the Chinese while we were co-leader with the Americans in the early 2000s. aid of 750 billion euros, the majority of which will go to Spain 140 billion, Italy (130) then France, Europe procrastinates since the payment will take place only in the last quarter of this year.

We no longer play in the same division and the slow reactions make Europe a follower and no longer a leader who has no chance of reaching the podium of the finalists in the next five years without a reform of the decision-making system. and a new organization.

In conclusion Brussels produces regulations while China and the USA produce goods and services….

Despite everything, the recovery is being felt and, as mentioned in the previous newsletter, residential real estate is on the rise again in Paris (+ 0.1% in April) and the stagnation only lasted 3 months. Rates remain historically low in real estate (1.10% on 10 years).

European financial markets are high but stocks are not overvalued unlike the SP 500.

There are therefore still investment prospects that offer opportunities in stocks that have not yet taken off or in sectors that are lacking.

Thus the Spanish market is attractive for yield, for the sector ST Microelectronics, European leader and Ryan Air to benefit from the recovery, see www.placementsexpert.com.

Do not hesitate to contact me and see you very soon.

Anticipations of the end of COVID and the return of growth in the USA, which will be greater than 6% this year, are fueling the American and European financial markets with a decades-long high on the CAC at 6,130 points. But the volumes do not follow and a correction of the order of 5% cannot be ruled out before August with renewed volatility. Take your profits and keep a cash position!

Concerning the real estate market: many contradictory messages from real estate players. The main message is that the position of real estate manager in companies is highlighted by the importance of the costs and savings it generates.

The crisis has given rise to very tight renegotiations of leases in the retail and office sectors with reductions of 30% on average, but the limit seems to have been reached. The owners took into account the difficulties of the companies and agreed to make efforts.

The traditional slogan “from now on nothing will be like before” is not at all realistic. It comes from communication professionals. For the record, in 1919, the 80 million deaths from the Spanish flu did not jeopardize the real estate markets or the boom in the stock market. Ditto for the Asian flu at the end of the 1950s. It's just a matter of supply and demand!

Recent studies underline that teleworking will not become a solution because more than 80% of employees (particularly executives) want to return to work to create a social link and team emulation. Their preferences being to telecommute one day a week.

As a result, the surface area of offices larger than 10,000 M² will not be disrupted, but their configuration will be modified, offering more space for exchanges and comfort than at home to develop "well-being" within the groups of work and improve productivity. We are likely to see an increase in renovation projects in this area.

It is the smaller surfaces that will benefit from strong demand, in particular business centers and co-working, because large companies will offer teleworkers the opportunity to “relocate” to offices close to their homes, which will cost less.

According to the Paris Workplace barometer, 63% of employees want more flexibility and it is on this trend that the demand for office property is moving.

This movement that is taking place around this "hybridization" (the word is fashionable) will certainly lead to downward and upward price distortions and a revision of the nature of the leases.

Concerning the walls and goodwill: as you have seen many goodwill are for sale and the walls for rent. Their valuations have fallen drastically and those with strong backs have done well to wait because there is a very strong correlation between the end of the pandemic and the return to normal activity. Timing speculators will see their trading window shrink significantly over the next three months. The end of the bargains is near.

Finally for residential real estate: despite all the rumours, prices remain solid in Paris, a drop of 2.9% over one year but an increase of more than 28% over 5 years (source Les Echos and Meilleurs Agents) compared to the fall in the GDP of 8.9% . Prices nevertheless remain high (over 10,300 euros/m²) which benefits the Ile de France (30% cheaper on average) which has seen increases of more than 3% over one year. This same study highlights that the attractiveness of the Ile-de-France departments and medium-sized towns has been boosted by the generalization of teleworking, making it possible to acquire more spacious housing with land. Strasbourg, Nantes, Rennes, Lyon and Marseille to a lesser extent recorded price increases of more than 3% in one year. The TGV effect is important to get to Paris.

In conclusion, transactions have slowed down but have not stopped. Prices have been renegotiated downwards but with a return to normalization as soon as health conditions improve (vaccination and reopening of public places). Signature deadlines have been extended but the markets have not “destructured”, they are “collecting”, they are adapting and are resilient. The second half of the year will see the start of the recovery in demand throughout the real estate sector.

To consult www.placementsexpert.com gallery section in real estate for current offers and investment recommendations for securities.

Since the beginning of the year the markets seem overly optimistic. The reality and the pitfalls are hidden around three themes:

The transformation of companies' business models and their real values.

Cryptocurrencies and bitcoin.

Rising interest rates, inflation and commodities.

Since the beginning of the year we have been witnessing markets that have broken records for 10 years. The SP 500 went beyond 3,900 points and the CAC 40 at 5,800 close to the February 2020 record. The explanation comes from the unjustified exaggeration of the valuation of certain companies like TESLA and the weight in the indexes that drive the markets up. There is also the emergence of the new digitalized economy led by the GAFA which benefits a set of companies present in this sector such as SHOPIFY FIVERR, SLACK, PINTEREST and fueled by significant cash held by public and private investors. themselves fed by central banks.

These new players are transforming the real economy and other sectors such as biotechnology, computer security and digital consumption are driving up the indices. They replace traditional modes of consumption by inventing new modes of consumption. Thus the insurance sector risks being upset by the arrival of an online platform such as LIMONADE, which is very easy to use and to subscribe with, in the end, more simplicity and saving time and money. The same is true in traditional sectors such as automotive and real estate where the “physical” agency is increasingly challenged by digital platforms to search for a property.

In conclusion, the markets are not overvalued but certain companies, because of their media exposure, tend to cause the indices to rise too quickly. Going back to TESLA, E. Musk's statements since January on bitcoin have contributed to a 20% surge in the price of crypto and fuel speculation.

So invest in companies that are properly valued with cash-generating business models that are leaders and innovative in their fields. You will remain more serene if the markets start falling again due to a return of inflation.

Bitcoin is not a currency: it is neither a means of exchange nor a safe haven, just a speculative value. The three functions of money being transaction, precaution and speculation in the Keynesian sense of the term, it is clear that two of these functions are not assured and will not be because of the insufficient volumes of emissions on the planet (21 Million) .

In the long term, it will be the biggest global scam because no government will authorize the development of bitcoin to the detriment of its monetary sovereignty. If you are a bitcoin holder, the first to come out will be the winners.

The return of inflation This is the third important point. Currently all the media and pseudo economists are worried. Gold :

1. Inflation is insufficient because it is hovering around 1% when we need 2%.

2. There is no inflation but price increases in certain sectors such as raw materials (rare earths) and energy. They have a direct effect on the prices of the manufacture of electronic components, which remain much more efficient than those manufactured 3 years ago. So an increase in prices that irradiate certain sectors of the economy such as the automobile but compensated by technological leaps.

Conclusion: Watch out for announcement effects because they can contribute to a little more market volatility, but keep in mind that the financial markets are planning a head start. New buy and sell recommendations are on the site www.placementsexpert.com (Investment recommendations section). "Heineken" to prepare for a hot summer and a return of restaurant openings seems appropriate to me.

Let me send you my best wishes and especially wish you good health in this very special time that we are going through.

As in all periods of crisis, the falls and recoveries of the financial markets have been times of great tension for investors. On February 19, the CAC reached 6,111 points to collapse on March 18 to 3,754 points, a fall of nearly 39% (-2,351) in less than a month. Catching up from the end of May made it possible to end the year at 5,572 points, showing a slight decline of almost 9% “but we saved the day”. This is the largest market drop recorded in such a short time since its creation in December 1987.

Even in 2002 when the CAC quoted 4,580 points on January 2, the significant fall had not reached this level since it had lost "only" 2,177 points (but 47%) on March 12, 2003 in 14 month space. As for the high reached on September 4, 2000 at

6,944 points Its drop of 1,761 points on June 27, 2001 (-25%) will remain a statistic.

We will especially note the violence of the variations due to an unforeseen event, which is horrified by the markets which are used to anticipating. These violent variations thus allowed investors who had cash to position themselves and present satisfactory results since between the low of March and December 31, the stock market recovered 48%.

This extraordinary year also confirmed growth sectors such as luxury (LVMH, Kering, Hermes)), technology (Wordline, Microsoft, Dassault system), health and biotech (Pictet Biotech, EDR data mining, BNP Aqua). Finally, companies undergoing digital transformation have also made strong progress, such as FNAC and Carrefour.

Conversely, the transport, holiday, banking and insurance sectors suffered sharp declines, such as Air France, SG, Axa, BNP, Auto Grill. The hotel and office sectors have been affected, and indirectly SCPIs specializing in this type of investment.

What about 2021? this crisis will allow certain sectors to restructure thanks to the help of the European Central Bank and its famous recovery plan of 750 billion Euros, of which the 3 main beneficiary countries are Spain, Italy and France. By continuing its low interest rate policy, the ECB is betting on a way out of the crisis this year at the same time as the distribution of the vaccine which will be the driving force behind renewed growth. In France, after a fall in GDP of 9% in 2020, the Banque de France forecasts growth of 6% this year.

Under these conditions, the growth stocks favored last year should continue to appreciate, but not as much as the so-called "value" or undervalued stocks which have fallen sharply and which could be the big winners this year thanks to a catch-up effect. . Thus all the values mentioned above represent opportunities. Their growth will directly depend on the return to normal of the economy (abolition of the curfew, reopening of all businesses and freedom of movement) on the pace of the pandemic and the development of the vaccine.

Another interesting year in terms of investments, with, in addition, prices of real estate assets holding up . A year that can hold many surprises for us. 2021 will be the year of the Metal Ox in China synonymous with tenacity and perseverance, a quiet force ready to climb mountains and protect those he loves. So be it !

Nicolas BLACHARD

Wealth management advice

Newsletter 88: The last of the year.

Outside of the decision period linked to the tax reduction, which is in full swing, many are wondering about the advisability of investing in 2021. Do not confuse the economic outlook with the financial markets. If the prospects for recovery in 2021 are still uncertain because of the health crisis, there are however elements of certainty such as the production and distribution of vaccines in developed countries which will play a fundamental role in economic recovery.

Another certainty is the ECB's support for economic players, which will extend its aid to the most affected European economies as much as necessary. The announcement of 500 billion euros in additional asset buybacks will help Italy, Spain and to a lesser extent France. Then everything depends on whether this aid will be used for structural or short-term measures...but that's another story.

Another certainty is that the French and Europeans are worried about health developments after the holidays, which will condition the reopening of public places and transport, cafés, bars, hotels, restaurants and cultural venues.

These sectors are very affected but others are in full development such as digital, construction, health, renewable energies, biotech. And it is not because there is an epidemic that the economy stops turning, in any case it is the desire of the political authorities.

Small reminder necessary in this first pandemic of the 21st century:

John Hopkins publishes 1,570,000 deaths worldwide, the vast majority (90%) of which are over 80 years old and 44 million cured. In the 20th century two great pandemics, the Spanish flu caused 30 million deaths in the world according to the Pasteur Institute and the Asian flu 2,000,000 deaths according to the WHO for a world population divided by two.

So is this the right time to invest? Yes, because the financial markets remain volatile and react strongly to the effects of announcements. If you have cash, opportunities arise in the real estate field: Sale of office buildings, commercial premises, businesses and hotels.

There will be no major restructuring of the real estate sector but adaptations related to working methods. Teleworking, which will still be limited, but also the use of new technologies will encourage companies to take up smaller areas. At the same time they will use more shared spaces in business centers. Hence the interest of investing in these assets.

SCPIs that have cash will also take advantage of this crisis to be on the lookout for investment opportunities and lower their acquisition price. Their investment horizons extending beyond 10 years, the performances will be visible around 2022-2023.

The financial markets: in the coming months, it's the opportunity to win or lose a lot (it all depends on your manager...). Be patient, responsive and opportunistic. You can consult the list and the sectors in which to invest onwww.placementsexpert.com/placements and if you bought Air France and Fnac as recommended the last 2 months you must be happy (+40%, +32%).

Whether in terms of tax exemption, investments and life insurance, or health insurance, provident insurance for you or your employees, Fides Patrimoine Finance can provide you with a solution. Do not hesitate to contact me.

Our real estate transaction and rental division is developing in Paris, Marseille in housing but also retail and office premises.

I wish you the best possible end of the year for you and your loved ones.

Nicolas BLACHARD

Financial markets will vary more with health conditions and how quickly the vaccine arrives than with US elections. The cash flows poured in by central banks are fueling the rise in equities, especially in growth sectors such as health, technology, data-mining, security, e-commerce. Some companies are in the process of making their digital revolution such as Carrefour and Fnac, others like Pinterest and Fiverr are growth stocks and precursors in new services. For more information see www.placementsexperts.com.

The end of the year is approaching here are several ways that I suggest to you to reduce your taxes.

- The PER: By far the simplest, the fastest, the most effective and the least risky. It's a double-trigger solution because you increase your pension and you reduce your taxes all at once. You deduct from your income the premiums you pay on your contract capped at €75,000. If your marginal tax rate is 41% this is not negligible.

- FCPIs: entitle you to a 25% tax reduction and exemption from capital gains on exit capped at a maximum subscription of €50,000 for a single person and €0033613614012 for a couple. They present both a liquidity risk because it is impossible to exit before 5 years and an inherent risk linked to the quality of the SMEs in which you invest.

- La Girardin Industrielle: This is a “one shot” investment intended for taxpayers paying more than €30,000 in taxes. Tax reductions of €50,000 are possible if you invest in an industrial tool intended for SMEs located in the DOM-COM. It is not a heritage investment, it is completely lost but you deduct more than what you subscribe with an obligation to keep the shares for 5 years.

- The Malraux Law and Historic Monuments for lovers of stone.

These types of investments are highly standardized both in terms of the legal arrangement and the monitoring of the work. You have to go through specialized companies (with which I work). For Malraux, work is deductible from overall income capped at €400,000 over a period of 4 years. The counterpart is to rent for 9 years. Several traps: it is long and the profitability is uncertain, the risks are important.

For MH the system is similar with all the same some differences.

Whether in terms of tax exemption, investments, or health and provident insurance for you or your employees, Fides Patrimoine Finance can provide you with a solution. Do not hesitate to contact me or consult my website https://www.placementsexpert.com.

Our real estate transaction and rental division is developing in Paris and Marseille in housing but also retail and office buildings.

Do not hesitate to contact me if you are looking for a property or seller.

See you soon.

Nicolas BLACHARD

Wealth management advice

Newsletter 86: The markets in a waiting position.

As stated in my previous newsletter the markets incorporate a degree of uncertainty

recurring since September based on the time needed to discover the vaccine. Another uncertainty is the US election, which in itself is no longer a factor of market volatility.

It is the economic outlook that is holding back investors who have nevertheless integrated the bad news concerning the possibility of a total reconfinement of the populations. In any case, it would seem that this hypothesis is ruled out.

Volatility remains present, double (26) a normal period on the French and American markets with fairly low volumes halved in the order of 2.5 billion euros on the CAC. This is why the latter evolves in a range of 300 Points 4750-5050 and the SP 500, 3200-3500...

There are therefore some market opportunities both in Europe and in the USA, particularly in “value” stocks linked to transport, travel and banking/insurance, provided that you are patient.

Some companies are about to complete their technological transformation with a significant development of their “market place” resulting in an increase in direct sales on their commerce platforms in addition to their stores. This is the case of FNAC-Darty, a value to be acquired as the end of the year festivities approach. Growth stocks are still relevant, those related to health, technology, data mining, IT security, biotechnology and development of clean and natural energies.

For more info on the values to follow: www.placementsexpert.com/ investment recommendations section.

If you need mutual insurance, health, retirement, for yourself or your employees, we have solutions.

Do not hesitate to contact me if you are looking for a property or seller.

Newsletter 85: Back-to-school letter: The real but incomplete recovery is making the financial markets uncertain.

The indices are doped with morphine of technology and growth stocks mainly guided by the American markets of the S&P 500.

The markets generate certain risks not because of the possibility of bubbles but rather because of the overvaluation of a few securities such as Tesla and Apple, whose market capitalizations artificially drive the indices upwards.

The health uncertainties linked to the rebound of the epidemic reveal a dichotomy between so-called safe haven and "scrap" values, such as the tourism and travel sectors, transport including aeronautics, the automobile and its sectors, and of course the banking/insurance sector.

The effects of announcements on the development and discovery of a vaccine explain why the volatility indices remain twice as high as in normal times. Consequently, the CAC evolved during the summer in a corridor of 4900-5100 points favoring or penalizing the sectors mentioned above.

It is particularly noted on the very exposed health values with consequent variations in a few days (Sanofi, Moderna, CSPC Pharmaceutical, Gilead, Novartis, etc.)

In conclusion: The market is dominated by uncertainty linked to the evolution of the Corona virus epidemic and the discovery of a vaccine.

- The recovery is real but incomplete, the world is in a situation of a marathon runner who would have completed 80% of the course but whose remaining 20% are the most difficult to complete.

- The announcement effects are dominant. Volatility may persist.

- Monetary policies remain accommodating and the billions injected by central banks support the economies still guided by Chinese and American economic statistics, the only world leaders.

- The recovery of the financial markets will be spectacular in the event of discovery of the vaccine and recession of the epidemic with indices which can increase by up to 20% and double for certain neglected stocks.

- In any case, keep your values for a period of 6 months to 1 year because if the health situation improves, the financial markets and the world economy could start up again at the end of the year or 1er quarter of 2021. You can then take your profits.

Reminder: the end of the year is near and the time for tax exemption is coming with new provisions that allow you to tax-exempt 25% instead of 18% on FCPI subscriptions. You can also open or top up your PER/PERP.

Do not hesitate to contact me in this case.

Nicolas BLACHARD

Wealth management advice

The economic situation is likely to deteriorate this year given the economic context, but it will be less so than expected. The tourism sector and its related activities, the hotel industry and the transport sector will be severely impacted and it will be necessary to wait until the end of 2021 to review the horizon. Until then there will be great opportunities to seize!

For the other sectors of the economy, the consumption indices are on the rise again, industry too, real estate is booming with rates starting to fall again, 1.25% over 10 years. These are signs of a recovery in economic activity that remain to be confirmed .

It should be noted that the household aid measures taken by the government during these months of confinement have considerably increased the savings of the French and the OFCE estimates that the latter have accumulated 75 billion euros in savings. Consumption with government incentives in the auto sectors aided by sustainably low rates will be the key to the recovery . Especially since households have become aware of the need to favor “made in France” purchases and holidays in mainland France.

Under these conditions and if there is no reconfinement or resurgence of the epidemic, we can think that the future will be less bleak than expected. An important point is the reopening of borders, which can be a double-edged sword. Either it revives the epidemic because of population movements, or it revives the economy.

In conclusion, we are sailing between two waters because the situation is not stabilized. The financial markets are anticipating, through their growth, a return to normal for the world economies, supported, it is true, by massive stimulus plans. It seems to us that the financial markets are a little too optimistic and the rebounds of the European and American indices are exaggerated. Nevertheless, the majority of analysts favor equity investments even if a consolidation is possible in the coming months.

Our investment preferences remain the same as before the crisis: Health, Technology and AI, Water, transport (to be kept for 2 years).

Do not hesitate to consult me on your needs for mutual health insurance, providence and sick leave in France and abroad as well as on questions of retirement, investments and taxation.

I wish you a good summer.

Nicolas BLACHARD

Wealth management advice

Conseil en gestion de Patrimoine

Nicolas BLACHARD

Wealth management advice

Where to find us :

19 Rue Eugene Manuel, 75116 Paris.

Mobile: +336 13 61 40 12

Paris: +331 45 04 88 55